Rising material costs, tighter regulations, and energy volatility are sending warning signals to packaging buyers worldwide.

Yes, essential oil glass bottle prices could surge up to 30% in 2025 due to raw material inflation, freight instability, and post-pandemic demand recovery.

If your brand relies on consistent packaging pricing, now’s the time to prepare—not panic.

What Factors Could Drive a 30% Price Surge in Glass Bottles?

Glass bottle pricing is closely tied to a few key cost drivers—and all of them are trending upward.

The 30% surge projection for 2025 stems from rising energy costs, sand shortages, labor pressure, and ESG-linked compliance fees across major manufacturing hubs.

Main Price Drivers:

| Factor | Impact |

|---|---|

| Energy Prices | Glass melting requires high temperatures—fossil fuel price hikes hit hard |

| Silica Sand Shortage | Key raw material; limited supply = premium prices |

| Carbon Tax Expansion | EU and other regions charge for CO₂ emissions from furnaces |

| Labor Cost Increase | Skilled labor wages rising in China, India, Vietnam |

| Currency Volatility | FX swings affect import/export contracts globally |

At PauPack, we’ve already seen raw glass pricing increase 10–15% in Q1–Q2 2024. If the trend continues, and EU green regulations expand, a 30% jump by early 2025 is within reach.

How Will Global Supply Chains Impact Essential Oil Packaging Costs?

Logistics is the second-largest cost component after raw materials—and it’s not stabilizing anytime soon.

Global supply chain pressures—including Red Sea disruption, port congestion, and container cost hikes—will add to essential oil bottle prices.

Current Supply Chain Challenges

| Issue | Result |

|---|---|

| Port Delays (Asia-Europe) | Transit time extended by 7–15 days |

| Freight Cost Inflation | $40–$80 more per cubic meter vs 2023 |

| Regulatory Checks | EU customs and inspection now stricter |

| Inventory Risk | Buyers holding more stock = capital lock-up |

At PauPack, we counter this with:

-

Warehousing support in China and 6 other countries

-

Just-in-time shipping partnerships

-

Dual-mode logistics (sea + air hybrid options)

This helps our clients buffer price shocks and stay stocked without over-ordering.

Is Now the Right Time to Lock in 2024 Bottle Prices?

If your 2025 launch is confirmed, you may want to secure packaging today.

Yes—Q3–Q4 2024 is the smart window to lock in pricing before year-end volatility and potential 2025 hikes.

Here’s how early ordering helps:

-

Secure lower unit prices before raw material contracts reset in January

-

Reserve factory capacity ahead of peak demand (especially Lunar New Year 2025)

-

Avoid rush premiums and sample approval bottlenecks

At PauPack, we allow clients to:

-

Lock 2024 prices for 3–6 months via pre-orders

-

Book container space in advance

-

Store goods in our bonded warehouse until ready to ship

How PauPack Helps Mitigate Price Volatility for Buyers?

We understand that pricing shocks derail product timelines and budgets.

PauPack shields clients with proactive forecasting, flexible contracts, and built-in cost controls across our global supply chain.

What we offer:

| Solution | Benefit |

|---|---|

| Transparent BOM pricing | Breaks down each cost so you know where increases happen |

| MOQ flexibility | Test new designs without overcommitting capital |

| Forecast-based production | Lock in rates by forecasting volume over 6–12 months |

| Green material subsidies | For brands using PLA, PCR, and other eco options |

| Multi-format sourcing | Combine glass, aluminum, and PET for price tier flexibility |

With 20+ production lines and our own design and QC teams, we ensure you get both price stability and design excellence—delivered on time.

What Strategic Moves Should B2B Buyers Make for 2025?

Price hikes can’t be avoided—but they can be managed.

Smart B2B buyers are locking in hybrid packaging portfolios, signing 2024 pricing agreements, and shifting to predictive procurement models.

Your 2025 checklist:

-

✅ Review pricing with key suppliers by Q3 2024

-

✅ Diversify formats (glass + PCR PET) for flexibility

-

✅ Use bonded storage to avoid overstock or rush fees

-

✅ Incorporate design efficiency (lighter bottles, fewer parts)

-

✅ Explore regional sourcing to cut logistics cost

At PauPack, we help you do all of the above through one streamlined process. Whether you're an aromatherapy startup or a global wellness brand, we align your design, compliance, and budget needs into a realistic, reliable plan.

What Regional Factors Are Driving Glass Bottle Cost Increases in 2025?

Glass bottle pricing doesn’t rise globally at the same rate. It’s regional dynamics that matter most.

In 2025, key markets like China, India, and Eastern Europe are facing energy constraints, labor cost inflation, and raw material shortages that will drive up glass bottle production costs.

Let’s break it down:

Cost Pressures by Region

| Region | Key Cost Drivers |

|---|---|

| China | Energy use caps, labor hikes, stricter emissions |

| India | Sand mining restrictions, fuel import costs |

| Vietnam | Skilled labor shortage, raw material volatility |

| EU | Expanded carbon taxes, glass recycling policy shifts |

At PauPack, we diversify production across multiple countries and maintain factory partners with different energy sourcing strategies—helping clients avoid price spikes tied to any single region.

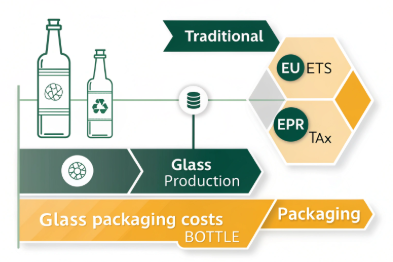

How Will Green Regulations Affect Glass Packaging Economics?

Sustainability rules aren’t just shaping product claims—they’re reshaping production costs.

New environmental policies across the EU, U.S., and Asia are increasing the cost of traditional glass production, especially where high-temperature furnaces run on fossil fuels.

Examples include:

-

EU ETS Phase IV: Adds carbon taxes to energy-intensive industries like glass

-

Plastic & Packaging Taxes: Pushing brands to switch to recyclable or reusable formats, often increasing unit complexity

-

Extended Producer Responsibility (EPR): Shifting disposal and recycling costs to the packaging brand

These costs don’t just hit manufacturers—they’re passed down the supply chain. At PauPack, we pre-negotiate with green-compliant vendors and offer recycled glass, lightweight bottles, and low-emission packaging alternatives to help our clients stay compliant and cost-efficient.

Can Customization Still Be Affordable Amid Price Surges?

Yes—but only if you optimize your packaging strategy.

Even with rising costs, brands can still afford unique bottle designs by adjusting factors like weight, shape complexity, finish, and order size.

At PauPack, we advise clients on how to reduce unit cost without sacrificing branding impact.

Cost-saving Customization Tips

| Element | Budget-friendly Adjustment |

|---|---|

| Bottle Shape | Choose mold-ready styles over full custom tooling |

| Glass Weight | Switch from thick glass to lightweight eco versions |

| Finish | Use standard color glass with printed branding vs full spray coating |

| Cap & Dropper | Simplify component count or use PCR plastic alternatives |

| Order Strategy | Batch orders quarterly instead of monthly to reduce per-unit logistics cost |

With 30+ in-house designers, we help you maintain product differentiation even in a cost-sensitive year.

How PauPack Optimizes Costs Without Sacrificing Quality?

We don’t believe in cutting corners. We believe in building smarter systems.

PauPack protects clients from price shocks by combining vertical integration, lean production, and modular packaging design—delivered at flexible MOQs.

Here’s how:

-

Factory-direct pricing from our 20+ automated lines

-

In-stock SKU options ready to ship with shorter lead times

-

Material alternatives like PCR PET, bamboo, or aluminum bottles

-

Bonded warehousing so you can order now and ship later

-

Global logistics partners to optimize freight per cubic meter

This model helped one of our UK clients reduce their essential oil packaging cost by 18%—despite rising glass prices—by switching to a pre-designed PauPack mold and locking in 2024 rates for Q1 2025 delivery.

What Forecasting Tips Can Help Buyers Plan Smarter for 2025?

If you’re not forecasting your packaging needs for 2025 now, you’re already behind.

Smart buyers are building 6–12 month procurement plans based on product roadmap alignment, market demand cycles, and supplier pricing trends.

Here’s your 2025 playbook:

Actionable Forecasting Tips

-

✅ Review 2024 consumption patterns and build Q1–Q2 projections

-

✅ Confirm upcoming launches and request samples now

-

✅ Schedule pricing calls with suppliers by August 2024

-

✅ Plan dual-sourcing if launching in multiple countries

-

✅ Create a buffer budget for glass-specific categories

PauPack offers support with digital forecast templates, tiered price tables, and cross-region packaging analysis to help your team negotiate from a position of clarity and confidence.

Conclusion

Glass bottle prices are likely to climb in 2025—but with early planning and the right partner, you can stay ahead of the curve. PauPack is here to help you forecast, adapt, and win.